Gold Buy Bullion: A Wise Investment Decision

In the evolving world of finance and investments, gold buy bullion remains a steadfast avenue for wealth preservation and growth. As people search for security in uncertain times, the allure of tangible assets like gold becomes even more significant. In this article, we will delve into the multifaceted aspects of gold bullion investing, addressing why it is a compelling choice and how one can navigate this investment landscape effectively.

Understanding Gold Bullion

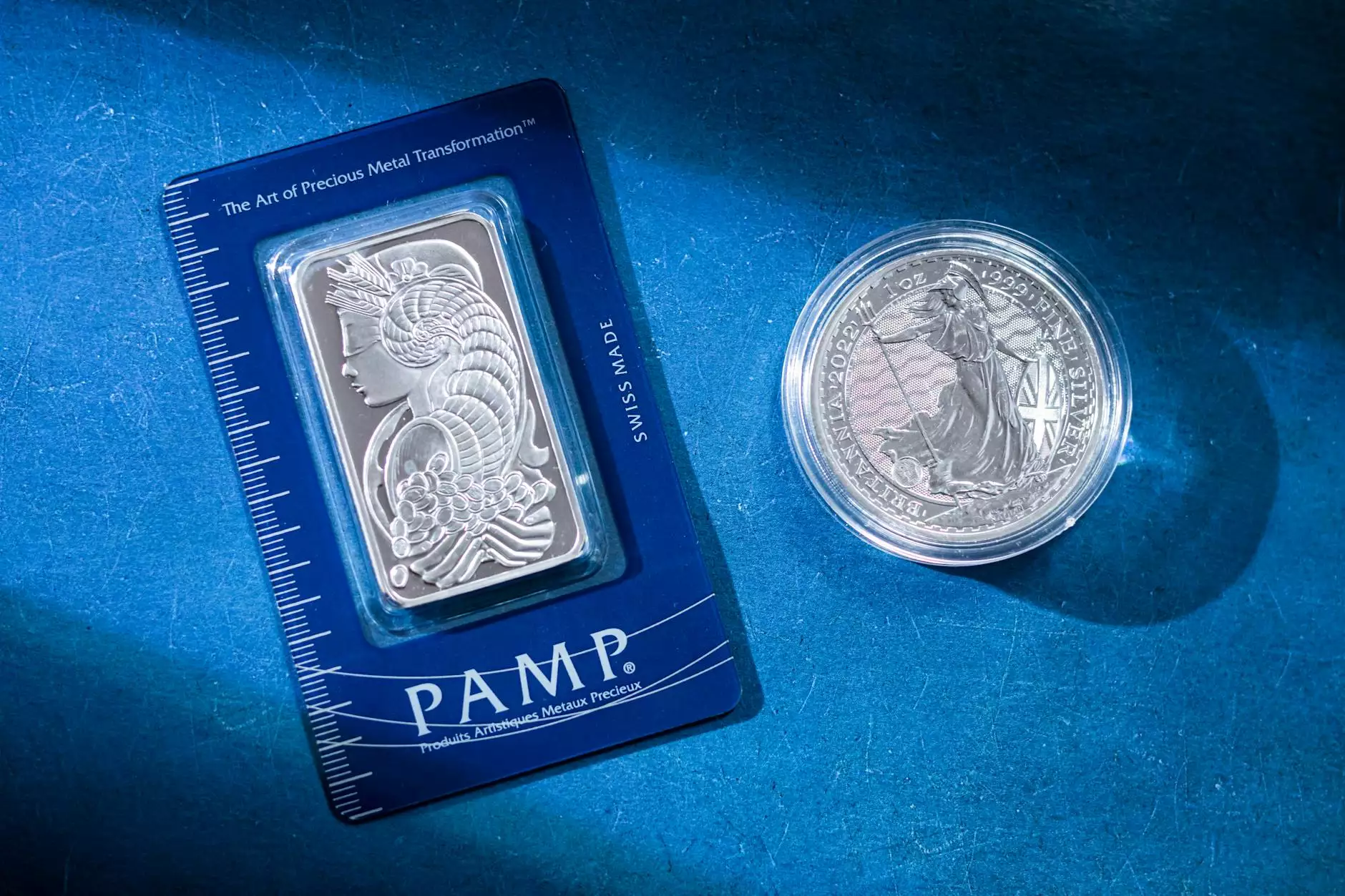

Gold bullion refers to pure gold that is usually in the form of bars, coins, or ingots. Unlike gold jewelry, which is typically mixed with other metals, bullion is made from a nearly pure gold content of 99.99%. This physical form of gold serves as a reliable hedge against inflation and market volatility.

Types of Gold Bullion

When deciding to buy gold bullion, it's essential to understand the different types available in the market:

- Gold Bars: Often available in various sizes, including 1 gram, 1 ounce, and larger blocks, gold bars are a popular choice for investors seeking to accumulate substantial quantities of gold.

- Gold Coins: Coins like the American Gold Eagle, Canadian Maple Leaf, and South African Krugerrand are not only visually appealing but also recognized globally.

- Gold Rounds: These are similar to coins but are not backed by a government and often come at a lower premium compared to official coinage.

Why Invest in Gold Bullion?

The question often arises: Why should I consider investing in gold bullion? Here are several reasons why gold bullion is a sound investment:

1. Hedge Against Inflation

Gold has historically been viewed as a hedge against inflation. When fiat currencies lose value, gold typically holds its value, making it a reliable store of wealth. This is especially crucial in periods of economic uncertainty.

2. Portfolio Diversification

Including gold bullion in your investment portfolio can enhance its resilience. Gold's price movements often do not correlate with stock or bond markets, allowing it to act as a stabilizing factor when other investments falter.

3. Tangible Asset

Unlike stocks or bonds, which are intangible, gold bullion is a physical asset. This unique characteristic provides a sense of security for many investors who prefer having ownership of actual commodities rather than digital representations.

4. Global Demand

Gold enjoys a robust global demand, particularly in emerging markets where jewelry consumption continues to grow. This intrinsic demand supports gold prices and solidifies it as a reliable long-term investment.